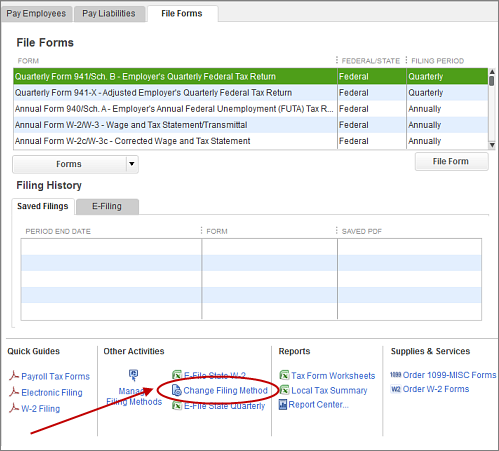

#Intuit quickbooks payroll form how to#

How to determine how much to pay yourself as a business owner If a company sells all of its assets for cash and then uses the cash to pay all liabilities, any cash remaining is the firm’s equity.Įach owner can calculate his or her equity balance, and the owner’s equity balance may have an impact on the salary vs. Accounts payable, representing bills you must pay every month, are liability accounts, as are any long-term debts owed by the business. Liabilities, on the other hand, are obligations owed by the business. Equity is based on the balance sheet formula :Īssets are resources used in the business, such as cash, equipment, and inventory. What’s equity? To put it simply, it’s an accumulation of money that has not been spent on the business or withdrawn over time for personal use. draw decision, you need to understand the concept of owner’s equity. When you contribute assets, you are given equity (ownership) in the entity, and you may also take money out of the business each year. Once you form a business, you’ll contribute cash, equipment, and other assets to the business. If not, the company is a pass-through entity. There are some exceptions, but generally a business faces double taxation as a C Corp. The partnership tax return documents the partners, the percentages of ownership, and the partnership’s profit-but no taxes are actually calculated on the partnership tax return. The $10,000 is then reported on her personal tax return as income from her partnership. The partnership would file a tax return and issue her a Schedule K-1, which reports the $10,000 in income. Assume, for example, that Patty’s catering business is a partnership and her share of the income is $10,000. Sole proprietorships, partnerships, S Corps, and several other businesses are referred to as pass-through entities. Pass-through entities : Generally, all other business structures pass the company profits and losses directly to the owners.If a dividend is paid, the dividend income is added to other sources of income on the shareholder’s personal tax return. The owners can retain the after-tax earnings for use in the business, or pay shareholders a cash dividend. Corporations: The C Corp files a tax return and pays taxes on net income (profit).There are many ways to structure your company, and the best way to understand the differences is to consider C Corps vs. salary decision, you need to form your business. I'm only a post away if you have any other questions.Before you make the owner’s draw vs. You may find this article about entering historical tax payments helpful too. Now your prior payments are entered, and you can get back to business. Press Done to save your work and Finish to close the window. After you have completed the steps to add your first payment, you can hit Next Payment and continue the process to add more payments. Selecting this option will cause the prior payment to show up in the bank register.Ĩ. Affect liability and bank accounts: Use this option if none of the account balances are correct.The prior payment won't show up in the bank register. Affect liability accounts but not the bank account: Use this option if your checking account has the correct balance.Selecting this option will cause the prior payment to not show up in the bank register. Do not affect accounts: Use this option if your QuickBooks accounts have correct balances.Push Accounts Affected to display options for how you want the payment to affect your Chart of Accounts. In the Taxes and Liabilities field, select the payroll tax item that you've already paid and enter the amount (note: you can add a memo to remind you what the payment is for).ħ.

Pick the Payment Date and For Period Ending date accordingly.Ħ.

Press Ctrl + Alt + Y or Ctrl + Shift + Y to open the Setup YTD Amounts window.Navigate to the Help menu and push About QuickBooks.You can enter historical tax payments for previous years by following these steps: Allow me to chime in, hope you're having a wonderful week.

0 kommentar(er)

0 kommentar(er)